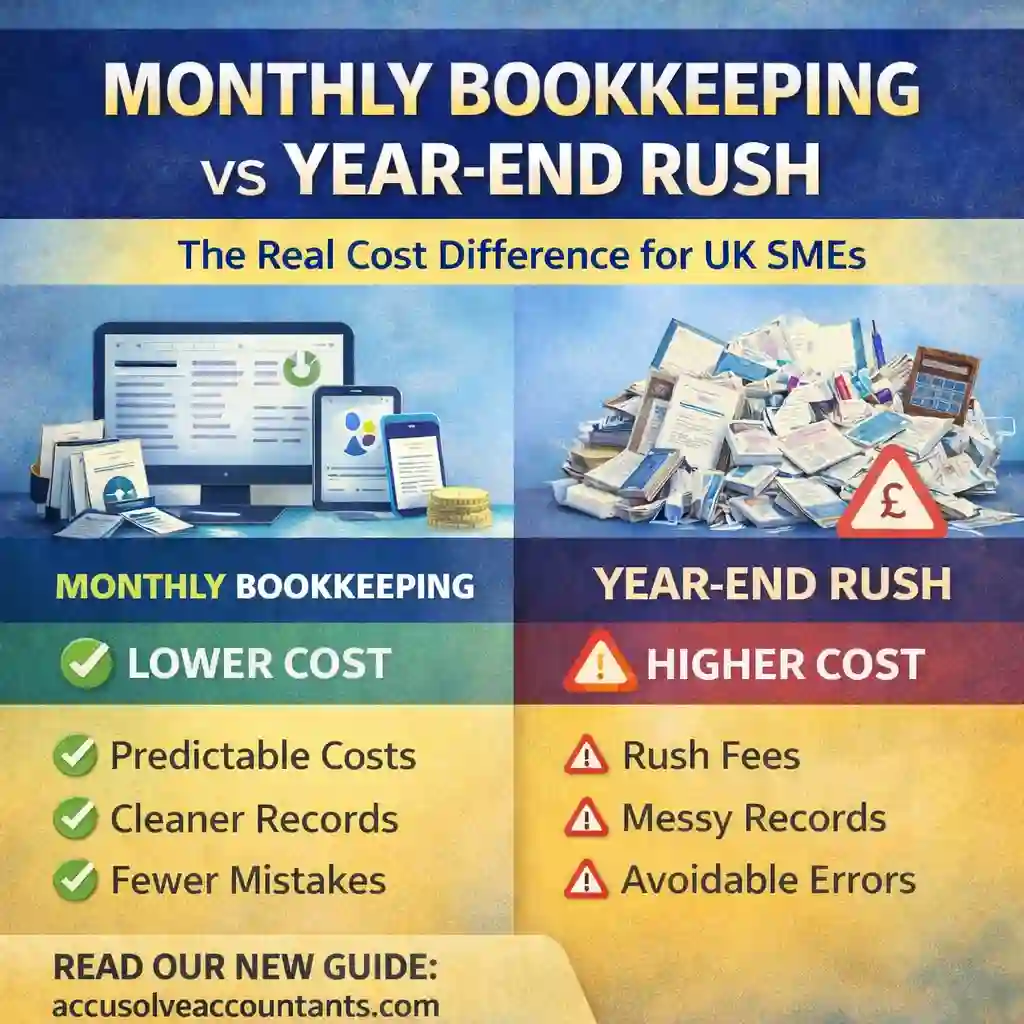

Monthly Bookkeeping vs Year-End Rush

Most UK SME owners don’t choose the year-end rush — it happens when bookkeeping gets delayed. The problem is that ‘later’ is the most expensive time to do it. This guide shows the real time/cost trade-offs and the hidden messy books tax that hits many limited companies.

Most UK SME owners don’t choose the year-end rush — it happens when bookkeeping becomes “something we’ll sort later”. The problem is that “later” is the most expensive time to do it.

This guide breaks down the time + cost trade-offs, explains the hidden “messy books tax” you pay when records aren’t kept up to date, and gives you a simple framework to decide which approach makes sense for your business. If you want hands-on help, explore our bookkeeping services or accounting services.

What “monthly bookkeeping” actually means (in plain English)

Monthly bookkeeping isn’t about perfection. It’s about keeping your records current enough that:

- your bank is reconciled

- your income/expenses are categorised consistently

- VAT/PAYE (if applicable) aren’t a surprise

- your year-end accounts become an admin task, not a rescue mission

A normal monthly cycle is: collect invoices/receipts → reconcile bank feeds → review uncategorised items → run a basic P&L check → fix issues while they’re still fresh. Using the right tools helps: see our accounting software setup (including Xero and QuickBooks workflows if relevant).

What the “year-end rush” looks like (and why it costs more)

Year-end rush bookkeeping usually means doing 12 months of work in a few days/weeks, when:

- bank transactions are uncategorised

- receipts are missing

- director’s loan and personal spend is mixed in

- payments don’t match invoices

- VAT returns were estimated or done without clean records

- the person doing the work has no context (because it’s months old)

And because the filing timetable is fixed, you lose negotiating power: you pay more to get it done fast. If you’re already close to a deadline, our annual accounts filing and company compliance support can help you recover quickly.

The real cost difference: a practical comparison

Here’s a realistic comparison for a typical UK SME limited company where the owner wants accounts done properly and on time.

1) Time cost (hours you’ll spend)

| Task | Monthly bookkeeping approach | Year-end rush approach |

|---|---|---|

| Transaction coding + queries | 15–45 mins per week | 10–30 hours in one hit |

| Finding/confirming receipts | Ongoing, easy | Painful, time-consuming |

| Reconciliation & error fixing | Monthly, small fixes | Big fixes + rework |

| Year-end handover to accountant | Simple pack | “Detective work” |

The key difference isn’t only hours — it’s the quality of hours. Monthly bookkeeping uses short, low-stress sessions. Year-end rush eats evenings/weekends and forces decisions without good data.

2) Money cost (what you actually pay)

Accountants/bookkeepers generally price based on transaction volume, complexity (VAT, payroll, multi-currency, e-commerce), how clean the records are, and how urgent the deadline is.

| Cost driver | Monthly bookkeeping | Year-end rush |

|---|---|---|

| Bookkeeping effort | Predictable | High + unpredictable |

| Accountant time | Review-focused | Rebuild + review |

| Urgency premium | Low | Often high |

| Error/penalty risk | Lower | Higher |

The “Messy Books Tax”: the hidden cost most SMEs don’t measure

The “messy books tax” is the extra cost you pay because your records aren’t clean when they need to be. It’s not a formal tax — it’s the real-world cost of clean-up, rework, missed claims, and avoidable problems.

Messy books tax shows up as

- Extra billable hours to reconstruct records

- Missed deductions (you don’t claim what you can’t evidence)

- VAT mistakes that take time to correct (see VAT returns)

- Director/personal spend confusion (often a director’s loan issue)

- Cashflow blind spots (numbers aren’t reliable until it’s too late — see cash flow forecasting)

- Opportunity cost (delayed decisions on pricing, hiring, investment)

A simple way to estimate your messy books tax

Ask yourself: how many hours did you spend last year finding receipts, explaining transactions, or fixing issues? Multiply that by your realistic hourly value. Even 10 hours of owner time at £50/hour is £500 — before you pay anyone to clean it up.

Why monthly bookkeeping usually wins (even for tiny businesses)

Monthly bookkeeping tends to win because it reduces clean-up time, reduces stress, and makes VAT/PAYE easier (where applicable). It also supports better decisions because your numbers are current.

If you have payroll, clean bookkeeping helps your payroll services run smoothly. If you’re a sole trader as well as a company director, keeping records tidy helps your Self Assessment too.

When a “year-end only” approach can still work

There are a few cases where year-end-only bookkeeping can be acceptable:

- Very low transaction volume (a few invoices a month)

- No VAT, no payroll, no complex expenses

- Business bank account is clean and separate

- The owner keeps strong records and receipts throughout the year

Even then, a light-touch quarterly review often prevents problems. Many SMEs choose a hybrid model using outsourced accounting so they’re not rebuilding the year at the last minute.

A simple hybrid that works for many UK SMEs

If monthly feels like “too much”, do this instead:

Weekly (10 minutes)

- Upload receipts

- Tag anything unclear

Monthly (30–60 minutes)

- Reconcile bank

- Clear uncategorised

- Check director/personal items are coded correctly

Quarterly (60–90 minutes)

- Review profit + rough tax estimate

- Tidy VAT/PAYE items (if applicable)

- Check debtors/creditors list

Month-end checklist (copy/paste)

- Bank account reconciled to month end

- Sales invoices raised and matched to payments

- Supplier bills recorded (or marked as missing)

- Receipt capture complete (fuel, travel, subscriptions, equipment)

- Director/personal transactions coded correctly

- VAT control checked (if VAT registered)

- Payroll journals posted (if running payroll)

- Profit & loss reviewed for anomalies

- Large one-off items noted (equipment, refunds, unusual costs)